ICRA projects that overall air passenger traffic will grow by around 8-11% year-on-year to approximately 407-418 million in FY2025. This growth is supported by a strong increase in both leisure and business travel, improved connectivity to new domestic destinations, and a continued rise in international travel. In FY2024, passenger traffic had already reached 376.4 million, marking a 15% year-on-year increase and surpassing pre-Covid levels by 10%. ICRA’s sample set1 revenues are expected to grow by around 15-17% year-on-year in FY2025.

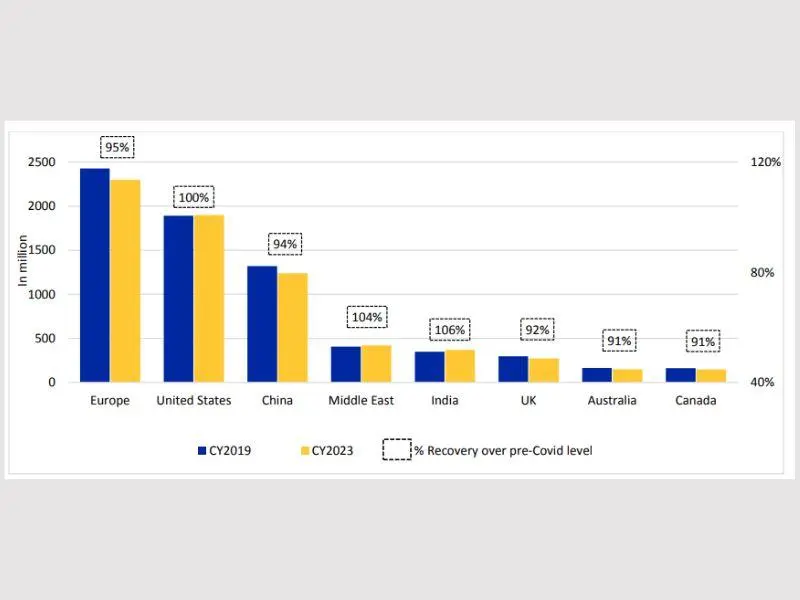

Giving more insights, Vinay Kumar G, vice president & sector head, corporate ratings, ICRA, said: “The recovery in the Indian airport passenger traffic is one of the best compared to other major global counterparts. India accounted for 4.2% of the global passenger traffic in CY2023, and its share in passenger traffic has improved from 3.8% in CY2019. While the global passenger traffic recovered to just 96% of global passenger traffic in CY2023, the Indian airport passenger traffic revived to 106% of the pre-Covid level owing to strong economic growth as well as the addition of new airport routes. The Indian air passenger traffic is expected to outperform the global trend.”

Further, the airport operators, regulator and other stakeholders have made significant progress in resolving the long-pending issues, viz., cost of equity, return on security deposits, forex losses, and treatment of real estate income. Also, variation in the amount of capex proposed by the operator and disallowed by the regulator had declined significantly to around 10% during the third CP from 25-30% during the first two CPs. Commenting on the airport operators’ performance, “The revenues of ICRA’s sample set are likely to grow by around 15-17% YoY in FY2025, driven by the sustained improvement in both domestic and international passenger traffic, increase in tariffs at some of the major airports and ramp-up in non-aeronautical revenues. With healthy profitability margins, the debt coverage metrics are expected to remain comfortable, despite higher interest outgo and debt repayments with the commercialisation of the capex programme at some of the key airports. The credit profile of airport operators is projected to remain strong, supported by healthy accruals and comfortable liquidity,” adds Kumar.

Automotive Body Coach Building

Hydraulic & Pneumatic Equipment

Industrial & Shipping Containers, Barrels And Drums

Insulators, Insulation Material & Accessories

Mechanical Power Transmission Tools And Accessories

Miscellaneous Automobile Parts, Components & Equipment

Miscellaneous Electrical & Electronic Items

Ship & Marine Tools, Equipment & Accessories